Top 5 Charts of the Week

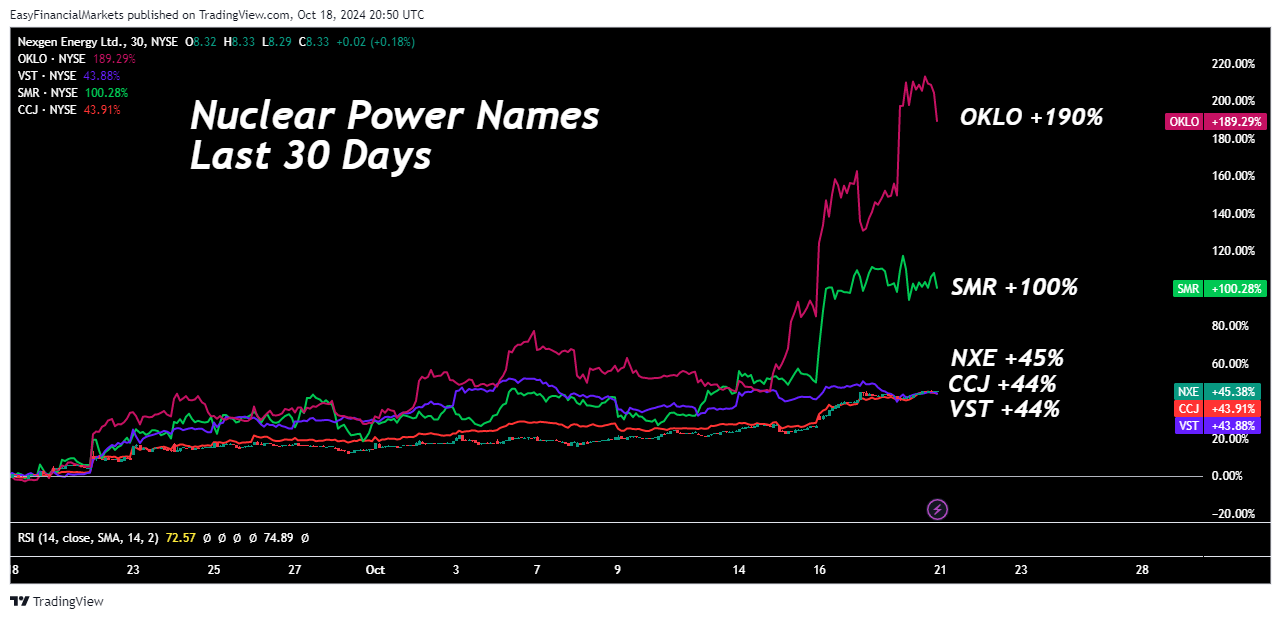

1. Nuclear Power Names are Surging

Equities related to Nuclear Power surged higher again this past week. While uranium and nuclear energy has been in a bull market for the past few years, AI has put this bull market on steroids. This past week; Google, Amazon, and other big-tech names announced investments into Nuclear projects, namely with SMRs (small modular reactors).

The future of energy is here.

2. Silver is Going Parabolic

While gold has quietly been the top performing major asset YTD, silver is now playing catch-up. Silver prices surged higher this week. While silver can benefit from monetary inflation in a similar way to gold, it also is a beneficiary of industrial economic growth. Any AI-infrastructure or electric vehicle production boom will benefit silver.

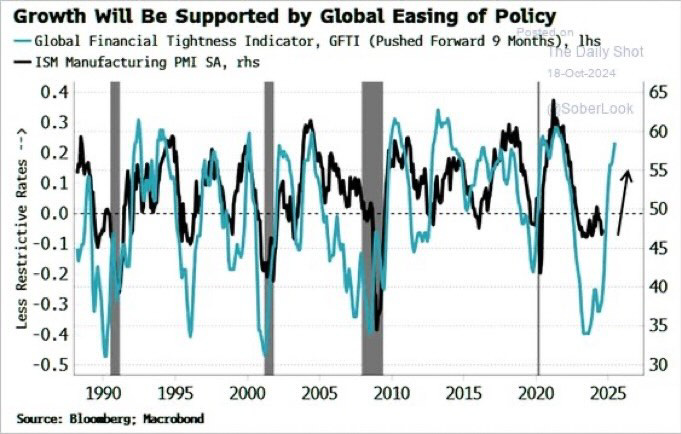

3. Liquidity Pointing to Economic Upside

With global liquidity rising, financial conditions have eased significantly. Credit spreads are tight, lending conditions are loosening, and asset prices are at the highs. This also points to some follow-through in the real economy.

The recent jump in yields shows that bonds are catching on to this.

4. Consumer Inflation Expectations are Soaring

This has gone under the radar. Within the latest University of Michigan Consumer Sentiment Survey, there was a massive spike in 5-10 year consumer inflation expectations. The rebound in bonds yields and spike in silver are inherently tied to this.

However, this also shows everyone is on ‘one side of the boat’ when it comes to expectations for the election. No matter who wins, the market is positive that government spending will continue…

And that’s the risk.

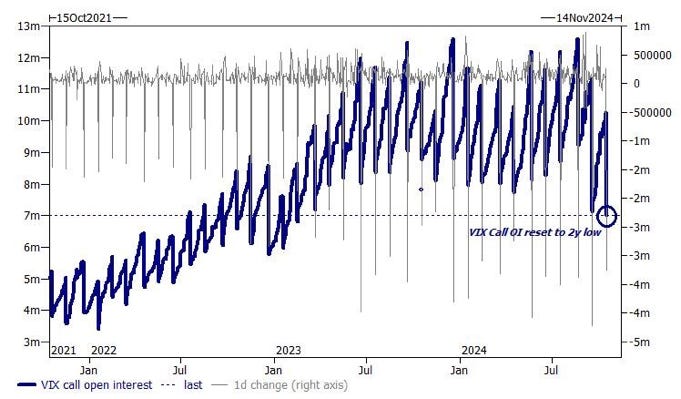

5. Nobody is Hedged for the Election

Open interest in VIX Volatility call options is at 2-year lows heading into a federal election. Huh? Again, the risk to the election that is not being priced is a split-Congress that leads to much less spending that anticipated. Government spending has been a huge tailwind to the economy. Unlike years past, a split-Congress is now the big risk. We wrote about this in our latest Substack - click here to read it.

Paid Subscribers can continue on from here!

As a reminder, we have officially started a paid-level subscription for the 2nd half of these notes. Within this subscription you get access to our full live-P/L portfolio and re-occurring trades ideas. Stocks, ETFs, crypto currencies, macro trades, we will have it all.

While we are starting the monthly subscription at $5 this will be the lowest it will ever be.

We have decided the best thing to do is a grand-fathering-in of subscribers.

Anyone who pays $5 a month will stay at that rate forever (yes even if inflation continues to sky-rocket).