Where Are the Election Trades?

If you’ve been in markets for more than a few election cycles, you know that by October the ‘election trades’ tend to be all the rage. By now, we’d usually see some sectors surging as one candidate gains traction, and elsewhere, other sectors falling due to policy fears. This time? There are basically no election trades at all. Why?

We have reached a point where incremental policy decisions do not matter for stocks. All that matters is that the Government keeps spending, money continues to be created, and liquidity flows into the S&P 500.

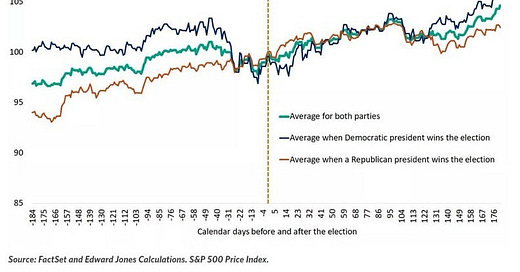

Stocks Tend to Move Higher After the Election

Markets tend to move higher following the US Presidential election, regardless of which party wins. This is largely due to ‘event vol’. Basically, so many people hedge for a known risk-event that no matter the outcome, many of these hedges come off, and volatility comes down. Short positions are then bought back and put options are closed, helping the market rally higher. Combine this with expectations of a budget deficit increase no matter the candidate and you get investors excited.

Everyone is Long

Clearly, this is well-known. Long positioning in US equity futures recently hit all-time highs. Sector and stock specific election trades are a thing of the past, an end-of-year run for the market as a whole, is what everybody thinks will happen.

Are Both Candidates Bullish?

“The greater the government debt load, the greater the incentive to implicitly and explicitly inflate it away in the future. The largest foreign holders of US bonds know this. No wonder they are buying gold.” - Bob Elliot

While the brilliant Bob Elliot is pointing to inevitable government deficits and monetary inflation being a reason for gold pushing higher, it also seems to be the reason why equities are running higher. Keep in mind, ‘monetary inflation’ is not the same as CPI, it is currency debasement.

Gold Longs at Record Levels

This thesis also seems to be driving gold. Long positioning in gold futures is now at multi-year highs.

Lessons From France

But here is where it gets interesting…

After their recent election, the spread between French and German bonds yields rose significantly. Note that a given European country’s bond yield compared to Germany’s is a classic sovereign debt risk indicator.

Why are investors becoming scared of France? Well, France is running 6% fiscal deficits with a decent economy despite having the highest tax burden in Europe. Government spending has become very important to the economy. However, there are two significant bottlenecks here.

1. Being a part of the EU means France doesn’t have its own currency and cannot enact large fiscal bills at will.

2. The recent election has led to gridlock, where not much will get done.

Putting it all Together

We don’t have many US election trades today because the ‘one’ election trade is that larger deficits mean more spending, which is seen as good for stocks. This is clearly consensus with S&P 500 futures positions at record highs. It is clearly consensus when everyone is bullish gold.

But the French election is a glimpse of the risk that nobody is discussing: A split congress.

For decades, a split congress in the USA was the most bullish outcome. It meant gridlock, which meant no changes. Business as usual! This is not the case in a world where economies are completely reliant on government spending increasing. This is what French yields are telling us.

There are two ways to deal with debt. Inflate your way out of it (US has been doing this) or austerity (China was doing this until a few weeks ago). The risk is that a split congress and gridlock inadvertently give us the policies of austerity (less spending).

In the coming months, watch out for the risk of China becoming the US with increased government support and the US becoming China with gridlock leading to austerity.

And while you’re at it, ask ChatGPT about the dynamics of a “fiscal cliff”, because that is the election trade nobody is talking about.

Paid Subscribers Below

We have officially started a paid-level subscription for the 2nd half of these notes. Within this subscription you get access to our full live-P/L portfolio and re-occurring trades ideas. Stocks, ETFs, crypto currencies, macro trades, we will have it all.

While we are starting the monthly subscription at $5 this will be the lowest it will ever be.

We have decided the best thing to do is a grand-fathering-in of subscribers.

Anyone who pays $5 a month will stay at that rate forever (yes even if inflation continues to sky-rocket).