1. Tesla Best Day Since 2013

Tesla rallied over 20% this week, which included the best day for the stock since 2013. Yes, they beat earnings, but the rally was all about future expectations. Expectations of autonomous cabs, a growing energy business, and a huge AI-buildout is what really sent the stock surging.

Put simply, Tesla was not being treated as an AI name… now it is.

2. The King Has Been Dethroned

Nvidia is officially the largest company in the country. Tesla’s surge helped renew optimism in the semiconductor space, pushing Nvidia above Apple to the #1 slot.

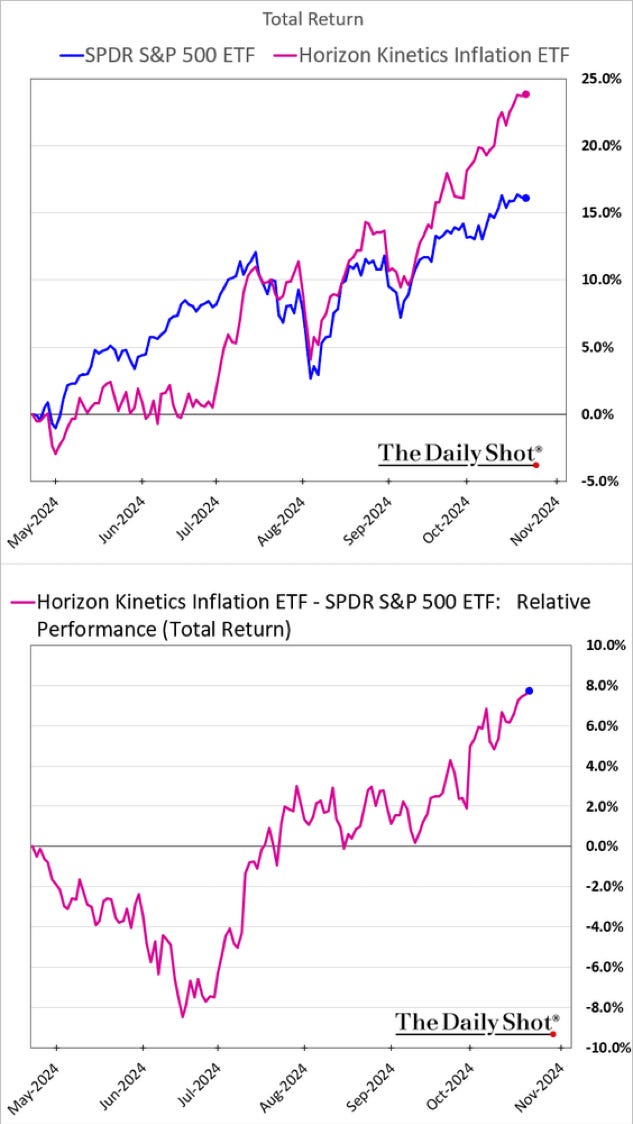

3. Inflation-Benefitting Stocks Rallying

The stock market is pricing in higher inflation ahead, as companies that benefit from rising prices outperform. This has been clearly tied to the rise in Trump’s election odds. The market views a Trump win (and really the rising GOP sweep odds) as inflationary. Rightfully so.

4. Investors are Hedging Treasuries

Similar to the outperformance of the inflation basket above, Treasuries have been selling-off with expectations of stronger growth and higher inflation ahead.

Notably, the cost to hedge against higher yields has soared to its highest level of 2024. Options premium on US 10-year treasury futures are heavily skewed to bearish hedges. BofA's MOVE Index of implied treasury volatility also hits a high for this year.

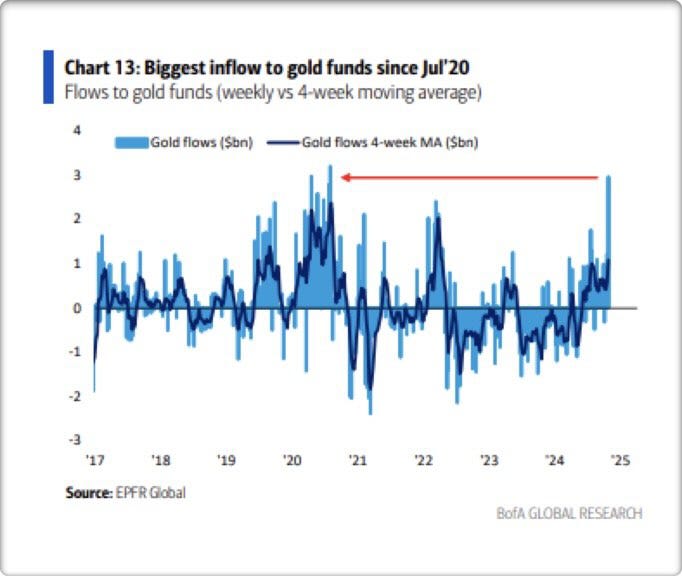

5. Gold Flows

Lastly, Gold continues to surge higher and this past week we saw this largest number of inflows from US investors since July 2020. Not only are other central banks buying more gold, but US investors see both candidates as bullish for the metal given both their spending promises. More spending = more Treasury issuance = more monetary debasement to come.

Paid Subscribers can continue on from here!

As a reminder, we have officially started a paid-level subscription for the 2nd half of these notes. Within this subscription you get access to our full live-P/L portfolio and re-occurring trades ideas. Stocks, ETFs, crypto currencies, macro trades, we will have it all.

While we are starting the monthly subscription at $5 this will be the lowest it will ever be.

We have decided the best thing to do is a grand-fathering-in of subscribers.

Anyone who pays $5 a month will stay at that rate forever (yes even if inflation continues to sky-rocket).